A Brief History of Liquidity

For most of the history of cryptocurrencies, assets were only tradable through a

centralized broker

or directly peer-to-peer. Decentralized exchanges emerged in the late 2010s but were

inefficient, centralized, and had poor liquidity.

In late 2018, Uniswap V1, the first true Automated Market Maker(AMM), premiered.

Liquidity pools

Uniswap introduced decentralized liquidity

pools. "Liquidity providers" or "LPs", could deposit

their assets into two-sided liquidity pools to provide liquidity for ERC-20/ETH

pairs and earn

trading fees. This process was later expanded to ERC-20/ERC-20 pairs on Uniswap V2. Uniswap's

architecture kept swaps fast and efficient for traders.

Note

Since then Uniswap's AMM model has become the dominant decentralized exchange model.

Numerous forks and

variations of Uniswap V2 have also emerged since then.

Incentivizing liquidity providers

Another process that emerged was protocols incentivizing liquidity providers with rewards to

increase liquidity in pools. This is known by many names, including yield farming, liquidity

mining, or mercenary capital. Liquidity mining was extremely profitable and helped grow DeFi

exponentially in 2020.

Conclusion

However, a long-term problem emerged during this growth period. Uniswap was not as efficient as

it could be. It lacked capital efficiency. Liquidity could only be provided full-range, meaning

that liquidity providers (LPs) had to provide liquidity far outside the ranges of the current

price of the assets. All LPs chose the same position. The only variable was how much they put

in.

Effects on the market

This relatively simple change had dramatic effects on the market. Liquidity pools became much

more efficient. Fees could only be earned by those who provided liquidity within the proper

ranges. Although LPs could still offer full-range positions, they became less competitive. The

liquidity concentration and range began to adjust in real-time to match the needed liquidity for

any pool. A dynamic new market emerged in the world of liquidity.

Algebra Finance

In addition to Uniswap V3, a new generation of decentralized exchanges and concentrated

liquidity models were built. Algebra

Finance became a major alternative to Uniswap V3 with

innovative features like dynamic fees.

Note

Algebra's growing number of supported exchanges used different token models like Solidly

and a more blockchain-native approach creating deeper liquidity for their users.

BUSL License expired

Uniswap V3's BUSL

License expired on April 1st, 2023. After it expired, established Uniswap V2

forks like PancakeSwap and

SushiSwap immediately adopted concentrated liquidity

Other non-fork exchanges like Balancer and Kyberswap also embraced concentrated liquidity

approaches.

Although there were doubts about the profitability and sustainability of concentrated liquidity,

Decentralized

Exchange Aggregators proved decisive in routing trades to them. Concentrated

liquidity now dominates the decentralized trading space.

Details

It's very important for liquidity providers and protocols to understand that they are now in a

competitive space. Nobody, no matter how skilled at management, is always profitable.

Pools can be oversaturated with liquidity for the amount of volume, which leads to poor fee

performance for the LPs, even in ideal conditions. High volatility can make even the

best-managed pools take losses. A group of users who gets incentives have a huge advantage over

those who don't have them. Full-range positions and sustained four-figure APRs are simply not

going to happen much anymore.

Regardless of whether you're a new solo liquidity provider, a seasoned farmer who rode the DeFi

Summer wave, or a traditional finance market maker, everyone now has to adjust to concentrated

liquidity's pros and cons.

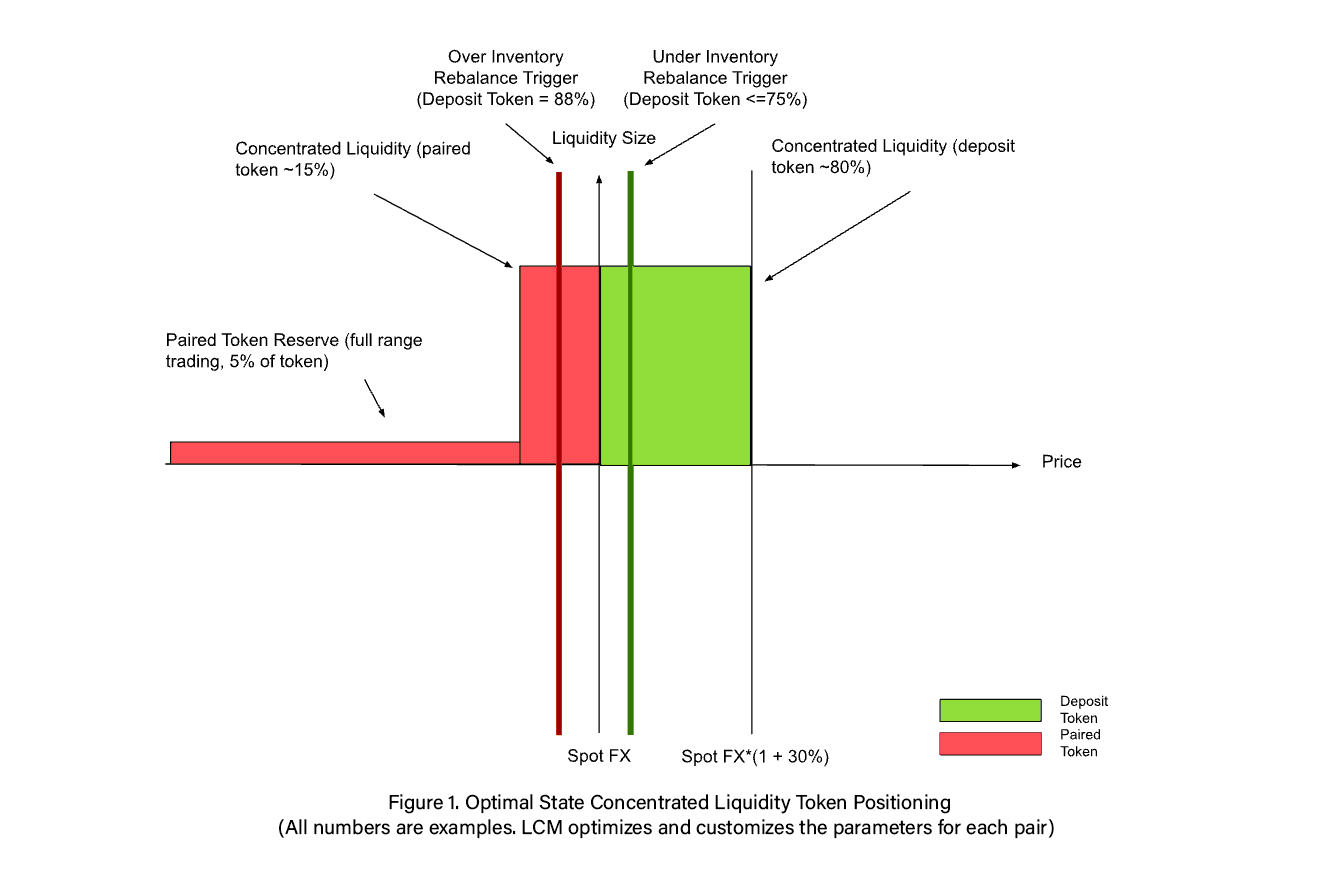

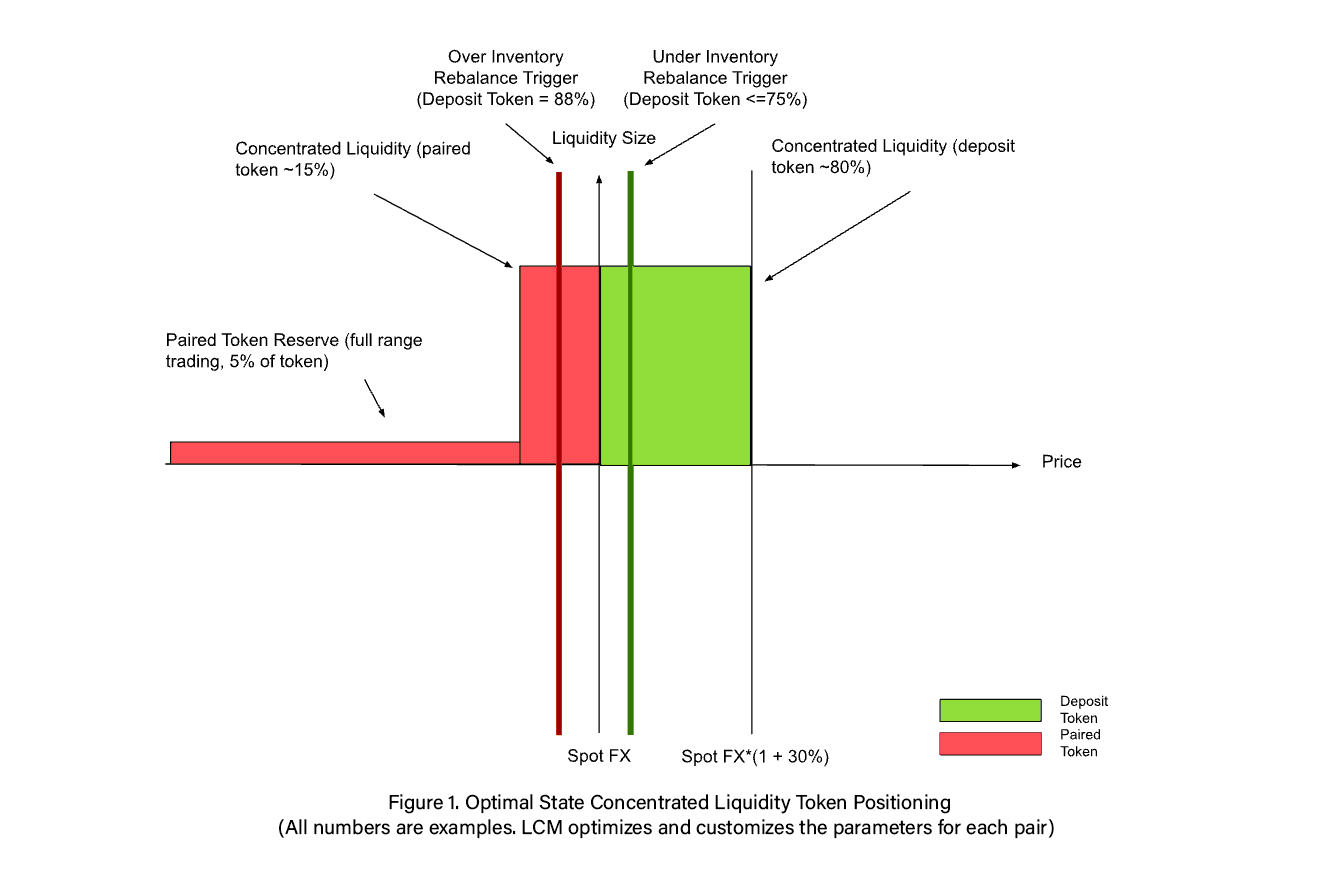

Optimal State

This represents the optimal condition that the rebalancing strategy endeavors to maintain for an

extended duration. It denotes a scenario where the price fluctuates within the designated range

of concentrated liquidity, facilitating efficient accumulation of deposit tokens via

concentrated trading fees. Within a healthy state, the allocation and concentration of tokens

are as follows

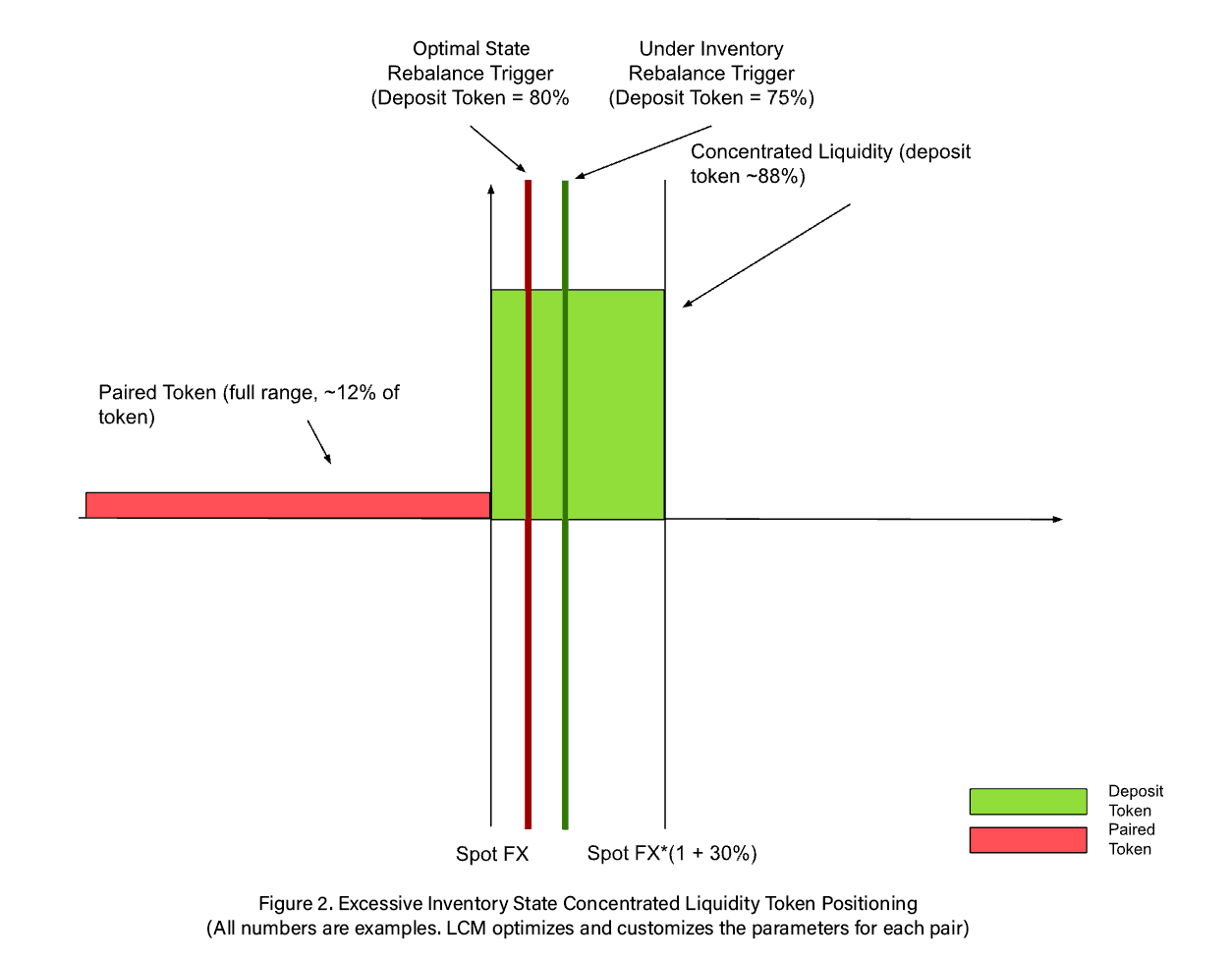

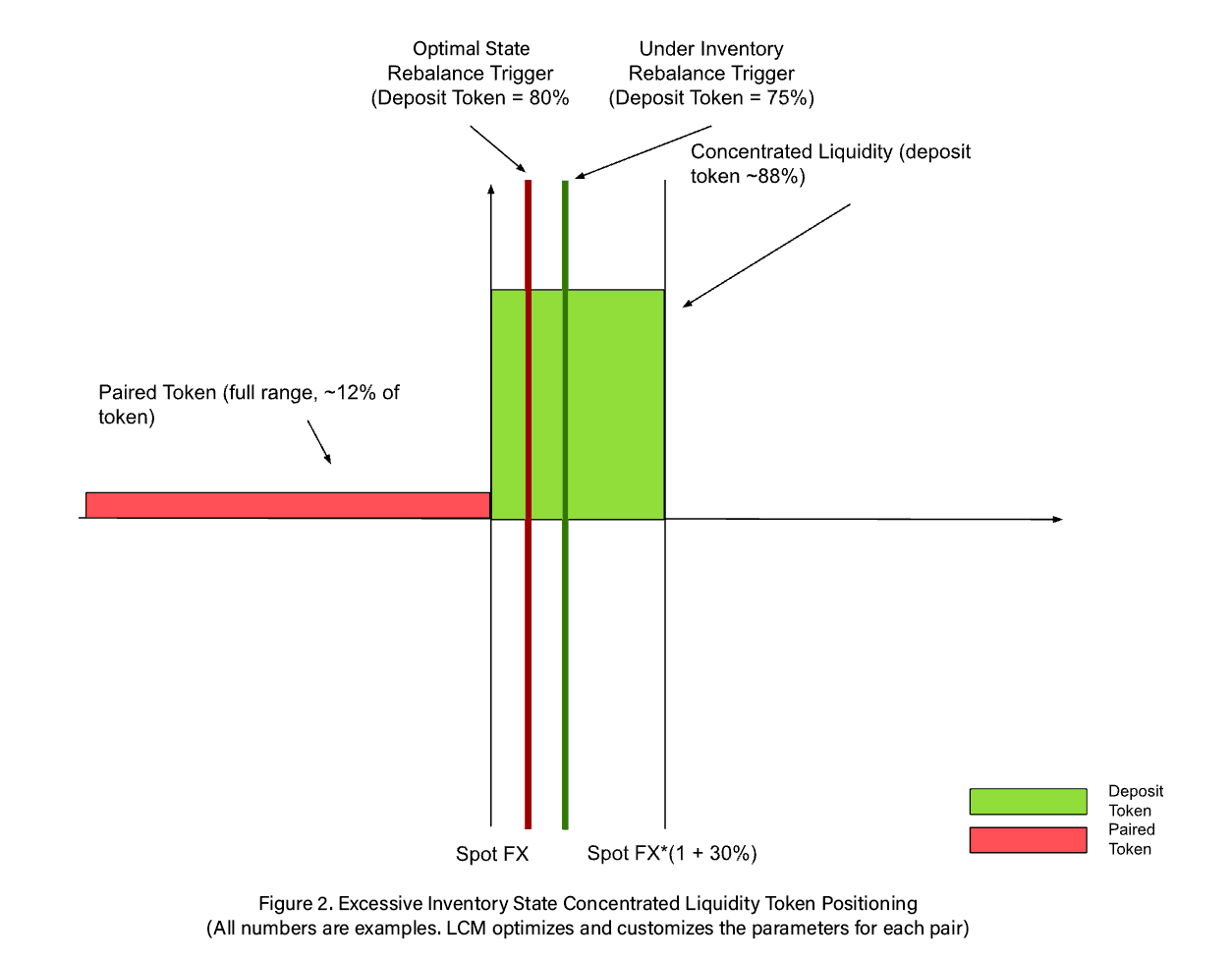

Excessive Inventory State

This condition (and the associated provision of concentrated liquidity) is activated in response

to an excess of deposit tokens. In the over inventory state, the rebalancing strategy adjusts

the vault's positioning to prioritize the sale of deposit tokens, aiming to restore it to a

optimal state. As depicted, a slight increase in the paired token spot FX prompts the

concentrated position to sell a significantly larger quantity of the deposit token compared to a

similar movement in the spot FX in the opposite direction.

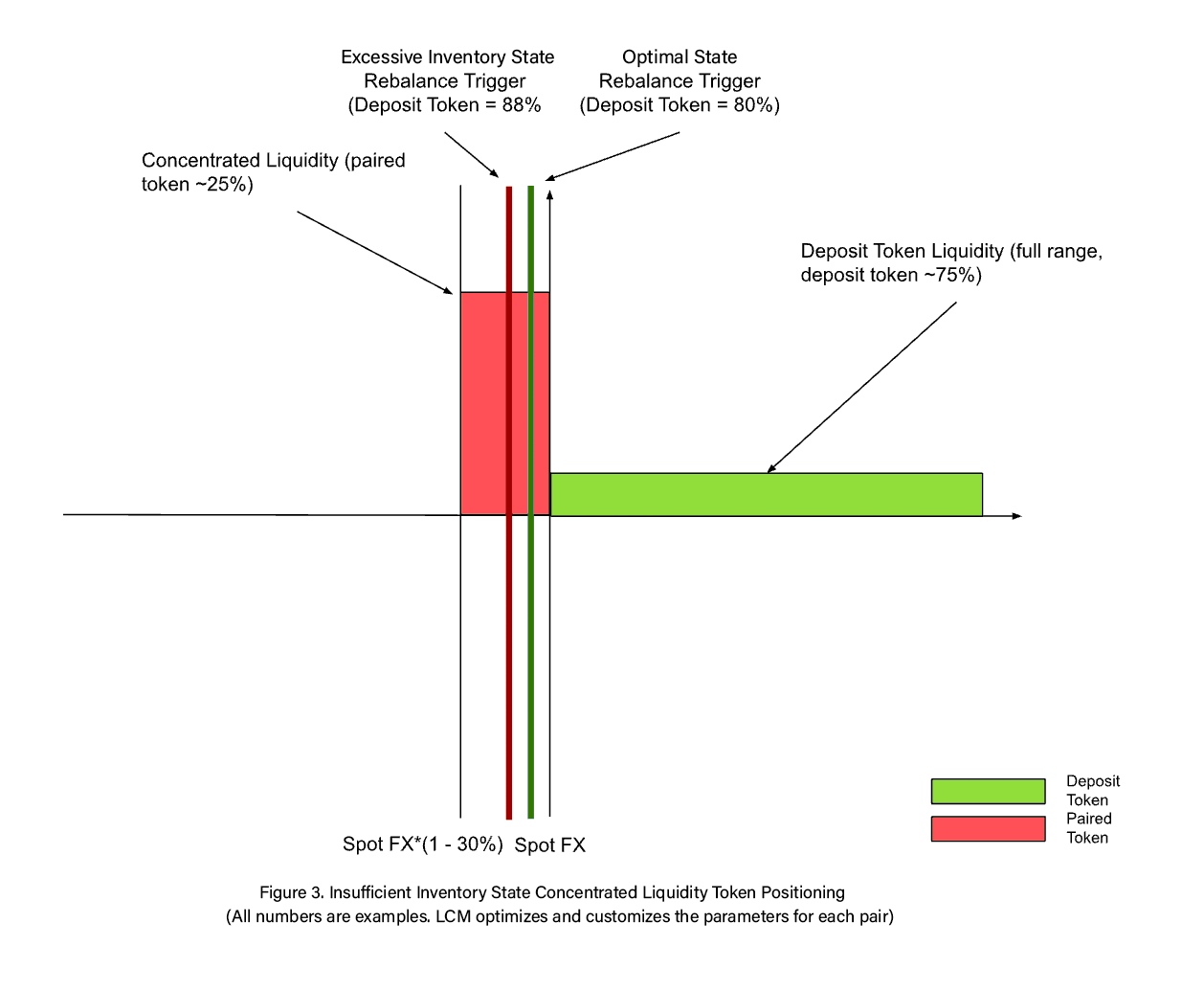

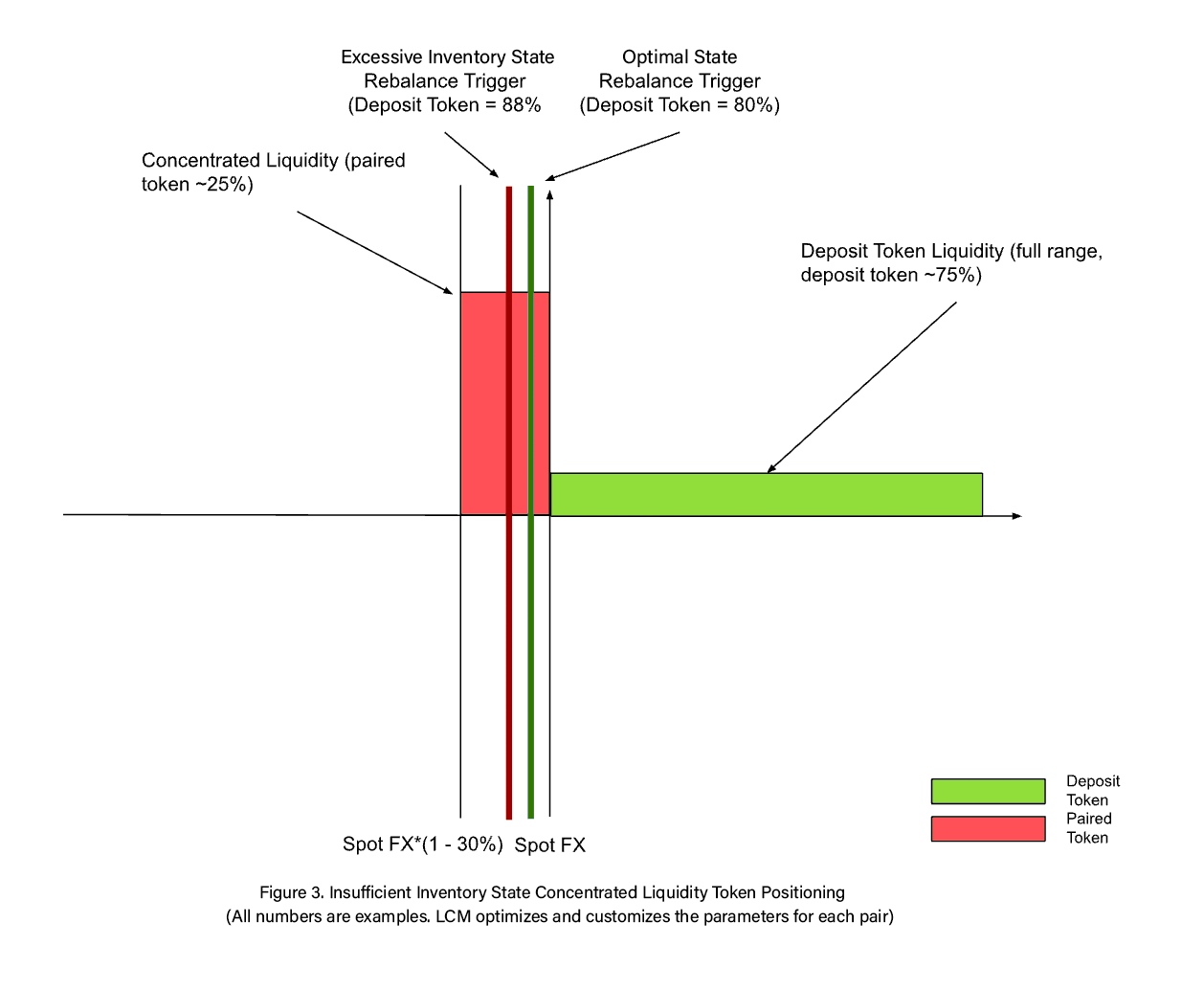

Insufficient Inventory State

This condition (along with the associated provision of concentrated liquidity) arises when there

is an insufficient amount of deposit tokens. In the under inventory state, the rebalancing

strategy adjusts the vault's positioning to prioritize the purchase of deposit tokens, aiming to

restore it to a healthy state. As demonstrated, a slight decrease in the paired token spot FX

prompts the concentrated position to buy a significantly larger quantity of the deposit token

compared to a similar movement in the spot FX in the opposite direction.

Exceptional Volatility State

Variances among rapid 5-minute and gradual 60-minute TWAPs, alongside disparities between the

present price and swift TWAP, will serve as indicators for detecting such fluctuations in price.

By default, a 6% variance activates the high volatility state. Within this state, liquidity will

be dispersed across the entire spectrum for both tokens.

Extreme Volatility State

Discrepancies between rapid and gradual TWAPs, along with variations between the current price

and rapid TWAP, will be employed for identifying these price fluctuations. By default, a 25%

deviation initiates the extreme volatility state. Within this state, the strategy will enter a

lockout phase, halting any additional deposits into the vault. It's essential to note that

during this period, the vault remains unbalanced, requiring human intervention to evaluate the

circumstances and determine the appropriate timing and method for rebalancing.

Automated Solutions

In order to enhance the capability for liquidity providers to establish robust on-chain

liquidity, LCM sought an efficient solution to scale their rebalance functionality.

Automating with Chainlink introduces a decentralized service designed specifically for handling

tasks on behalf of smart contracts. This system utilizes decentralized, highly reliable, and

economically incentivized automation nodes to activate smart contracts precisely when they need

to execute critical on-chain functions. These functions typically occur at regular intervals

(e.g., daily at a specific time) or in response to external events (e.g., when an asset reaches

a predefined price).

Key Attributes of Chainlink Automation

1. Decentralized, Reliable, and Efficient Automation — Chainlink Automation ensures swift

transaction identification and confirmation, even in periods of network congestion, utilizing

Chainlink’s proven transaction manager.

2. Cost-Effective, Time-Tested Infrastructure — Leveraging Chainlink Automation allows us to cut

in-house automation infrastructure expenses, decrease DevOps resource allocation, and enhance

overall speed and efficiency.

3. Facilitates Rapid Scaling — Chainlink Automation provides the capability for faster scaling,

circumventing the challenges associated with constructing and maintaining the infrastructure

necessary for reliable automation across multiple chains.

4. Unleashes New Possibilities — Through smart contract automation, we can explore novel use

cases and unlock functionalities that would have otherwise been unattainable.